Let’s just be knife eroticismclear upfront: New Year’s resolutions almost never work.

Their failure rate is so high, I’m half embarrassed to suggest one. I’ve yet to ever keep one myself; the success of this year’s attempt to avoid injuries by stretching after exercise can best be summed up by my midyear herniated disc.

One of the many reasons resolutions don’t work is that we get this intense urge to be a better person in early January, then a few weeks later we turn back into the person we really are. For me, that’s apparently someone too lazy to spend three minutes stretching.

But the resolution I’m going to propose doesn’t take yearlong willpower. It doesn’t even require that you save more, something that Americans surveyed by NerdWallet said they flat-out won’t do next year. It’s a one-time decision that you can implement during those few short weeks when you’re the best version of yourself: Switch to saving for retirement in a Roth IRA or Roth 401(k).

You’ll give up the immediate tax savings of the status quo — a traditional IRA or 401(k), the version you’re probably using — but you’ll gain a pool of tax-free money in retirement.

Full disclosure: I’ve been meaning to get around to making this switch for, oh, 15 months, so this is my resolution, too. Over half of plan sponsors now offer a Roth version of the 401(k). My employer is one of them, but I chose the traditional option for the same reason most people do: Contributions to a traditional 401(k) cost less in the moment, because they come out of your paycheck pretax.

With a traditional 401(k) or IRA, you defer taxes until retirement, when distributions from the account are taxed as income. With the Roth version of these accounts, you pay taxes upfront. You make contributions with after-tax dollars, but distributions of both your contributions and investment growth are tax-free in retirement. (Those coveted tax-free distributions are one reason the IRS puts income limits on Roth IRA eligibility; there are no income limits, however, on participating in a Roth 401(k).)

How those different tax treatments work in practice: Saving 5% of a $50,000 salary comes out to about $96 every two weeks. But if you make that contribution pretax to a traditional 401(k), it might reduce your paycheck by only around $75. The money you save on taxes now will be money you owe in retirement, but to me and probably to you, paying for something in 30 or 40 years — or even 10 or 15 years — sounds more appealing than paying for it right now.

When you contribute to a Roth 401(k), that 5% will reduce your paycheck by the full $96. So why would you do it? Because as any good Roth IRA calculator will show you, you’re banking highly valuable future tax savings.

Even as I opted for the traditional 401(k), I knew I should’ve chosen the Roth version. The standard Roth vs. traditional decision makers all point to Roth for me. I’m young, or at least youngish. While I can’t predict tax rates, it’s not a stretch to think they could go up by the time I retire. I certainly hope my salary hasn’t yet peaked. All of that means paying taxes now via a Roth and avoiding them later makes sense.

But as Tim Maurer, a financial planner and fellow Forbes contributor, told me when I was researching a recent article about Roth 401(k)s, even if all of those factors point to a traditional IRA or 401(k) for you — meaning you want to put off taxes because you expect your tax rate to be lower in retirement — the Roth is very often still a better bet.

That’s because unless you contribute to the traditional account and then invest the tax savings you receive from that contribution, money in the Roth will be more valuable in retirement. When the 65-year-old snowbird version of yourself pulls money out of a traditional account to buy a condo in Florida, you’ll have to pull out the down payment plus enough to cover taxes on the distribution.

If you can instead tap a Roth, you only need to pull out enough for the down payment. Having money you can tap tax-free in retirement also allows you to manipulate your taxable income. You may be able to use Roth money to keep yourself in a lower tax bracket, reduce taxes on your Social Security benefits and lower the cost of Medicare premiums that are tied to income.

None of that matters much when you’re young. And the switch may be a painful adjustment at first; you’ll need to get used to a slightly lower paycheck, a slightly smaller tax refund or a slightly higher tax bill. But like much of retirement planning — and, for that matter, resolution-making — this decision is a favor to your future self.

Greenpeace activists charged after unfurling 'Resist' banner at Trump Tower in Chicago

Greenpeace activists charged after unfurling 'Resist' banner at Trump Tower in Chicago

What is Clubhouse? Good luck getting invited to the social app.

What is Clubhouse? Good luck getting invited to the social app.

Candy Crush

Candy Crush

Watch a distant planet's vast orbit in spectacular time

Watch a distant planet's vast orbit in spectacular time

NYT Connections Sports Edition hints and answers for January 16: Tips to solve Connections #115

NYT Connections Sports Edition hints and answers for January 16: Tips to solve Connections #115

The Morning News Roundup for June 2, 2014

The Morning News Roundup for June 2, 2014

Get alerts for unknown AirTags on an Android. Here's how.

Get alerts for unknown AirTags on an Android. Here's how.

Olivia Rodrigo visits White House to encourage young people to get vaccinated

Olivia Rodrigo visits White House to encourage young people to get vaccinated

Best Amazon deal: Save 20% on floral and botanical Lego sets

Best Amazon deal: Save 20% on floral and botanical Lego sets

Robotaxis can now trundle the streets of San Francisco 24/7

Robotaxis can now trundle the streets of San Francisco 24/7

Early Prime Day deals on self

Early Prime Day deals on self

Ottessa Moshfegh and Susan Stewart Win Pushcart Prizes

Ottessa Moshfegh and Susan Stewart Win Pushcart Prizes

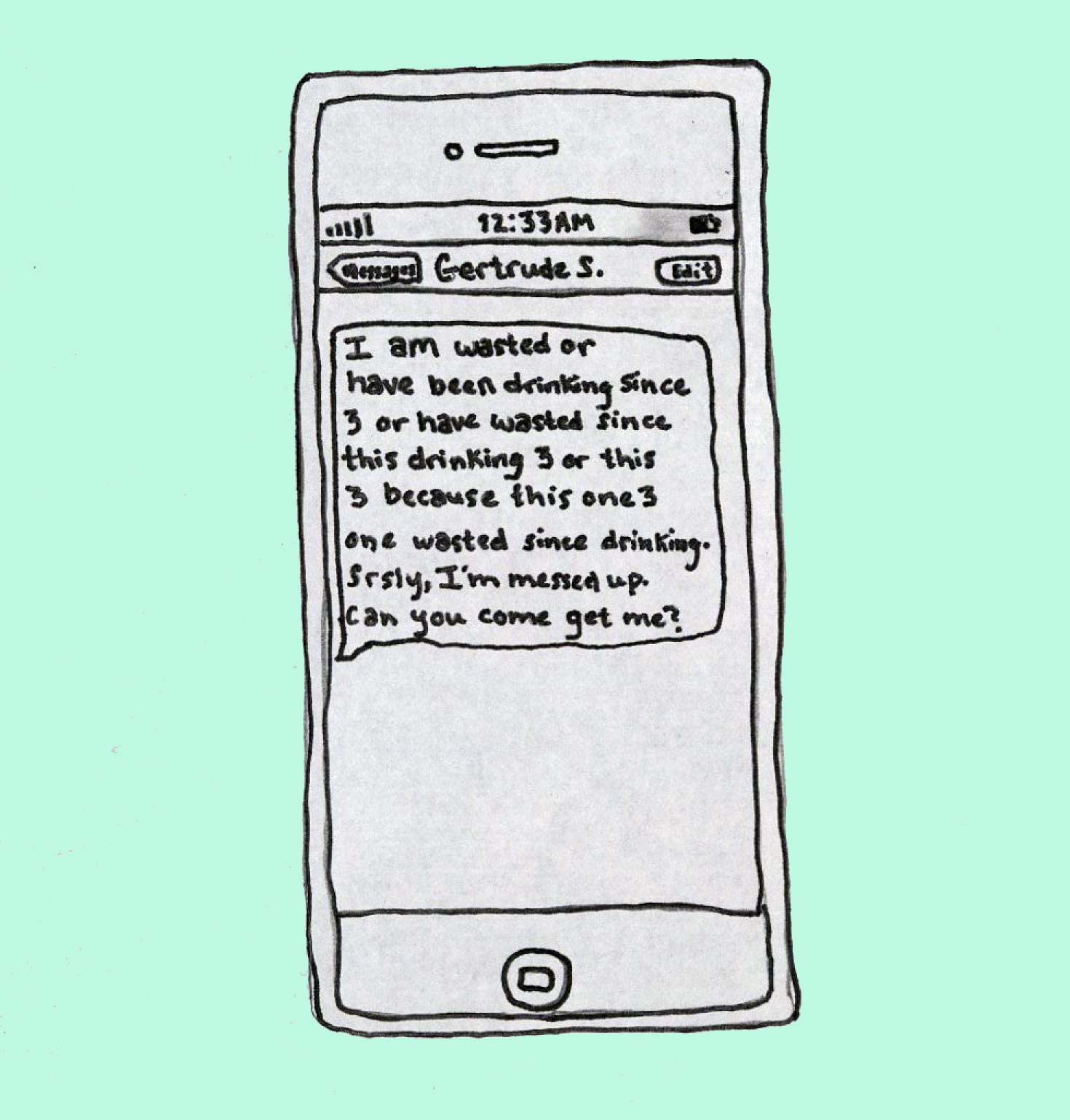

Drunk Texts from Famous Authors

Drunk Texts from Famous Authors

Wizards of the Coast

Wizards of the Coast

Dallas Mavericks vs. Boston Celtics 2025 livestream: Watch NBA online

Dallas Mavericks vs. Boston Celtics 2025 livestream: Watch NBA online

Get alerts for unknown AirTags on an Android. Here's how.

Get alerts for unknown AirTags on an Android. Here's how.

The Morning News Roundup for May 30, 2014

The Morning News Roundup for May 30, 2014

Get alerts for unknown AirTags on an Android. Here's how.

Get alerts for unknown AirTags on an Android. Here's how.

The Apple Watch is likely getting a major redesign in 2024

The Apple Watch is likely getting a major redesign in 2024

What your favorite Snapchat filter says about youFalse alarm: DNC backtracks on voter database hacking attempt claimPhotos of Hurricane Lane from space show the storm's extreme size'Ice Cream Books' is your delicious Instagram for summer readingiFixit cracks open the $2,295 Magic Leap One to inspect its gutsXiaomi's Pocophone F1 is crazy cheap for what it offers'Crazy Rich Asians' is getting its sequel – and it's great news for one fanThe eastern bettong is an adorable Aussie animal that just wants your love'Sekiro: Shadows Die Twice' kicked my assNASA spacecraft OSIRISDJI announces new foldable Mavic 2 Pro and Mavic 2 Zoom dronesThis Twitter thread is here to call you out for never shutting up about that one classic you readSony is bringing its robot dog Aibo to the U.S. this fallBritish phone company slams Twitter user in the most beautifully brutal wayiFixit cracks open the $2,295 Magic Leap One to inspect its guts'Reigns: Game of Thrones' lets HBO fans write their own Season 8Barista's attempt to make heart latte art results in impressively NSFW imageSony is bringing its robot dog Aibo to the U.S. this fallElon Musk decides not to make Tesla a private company after allHow to take part in 'Unite for Justice' protests and #StopKavanaugh Instagram is becoming more like Facebook Here's what Emma Watson thinks of 'Fantastic Beasts' Your future air conditioner might suck carbon dioxide out of the air Hotel's magical Christmas decor comes from Apple designers Donald Trump's grandfather was banned from Germany for avoiding military service 'Toy Story 4' makers explain why this movie is a thing that exists Facebook redesigns app and website around groups and IRL connections Gay woman buys dinner for the homophobic family sitting next to her Crowdfunding is giving parents all the baby gear they didn't know they needed 'Top End Wedding' brings the rom Trump supporters are pissed he won't pursue charges against Hillary Clinton Huawei's phone sales grew big time as Apple and Samsung's declined This 'Game of Thrones' fan predicted the ending of the Battle of Winterfell a year ago Mom hilariously can't remember the names of her daughter's friends Taylor Swift says fans figured out the name of her album. Here are their best theories. Facebook Messenger unveils new video and business features Review: The Forest app helps you go phone Drake gave the perfect shout out to Arya Stark and everyone's in a spin Donald Trump floats Nigel Farage for ambassador post No one noticed, but Uber and Lyft stopped accepting new NYC drivers

3.3785s , 8288.8828125 kb

Copyright © 2025 Powered by 【knife eroticism】,Miracle Information Network